So the GDP numbers came in lower than expected, which naturally puts the already over talked about Housing bubble back in to play. Alot of Analysts have been calling for a bottom but the GDP data has shut those mouths for now. Inflation data came in lower at 2.3% but is still above the feds 2.0% desire. Bond markets have rallied hard in the last two days because of the GDP and inflation data, which puts the inverted yield curve at its highest level since its inversion began. This puts a growth scare still in play. Read John mauldin's recent report to get a more detail idea of all this data. http://frontlinethoughts.com/article.asp?id=mwo102706

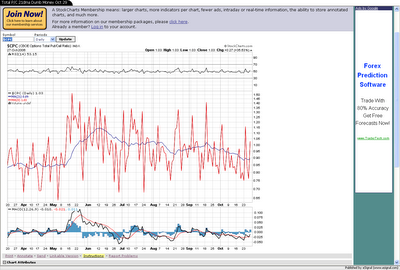

The Smart Money is getting Bearish!!!!!

The dumb money is starting to, way off levels it was at in Jun, Jul & Aug

No comments:

Post a Comment