Also take notice on what was red today, $DJUSBK, $bkx (banks) and the $XBD (brokers). These were the two main sectors (financials) that lead this rally up.

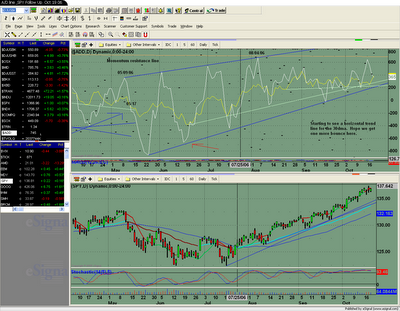

We are devoloping a horizontal trend line on the 30dma (A/D line). It also tested the rising trend line and reversed.

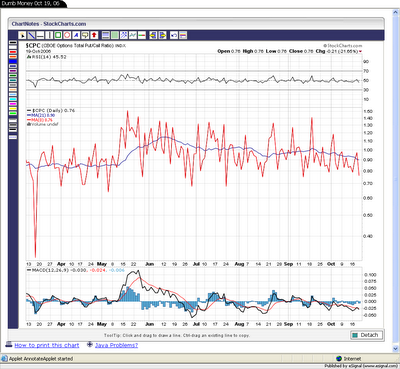

The Smart money have rather quickly become bearish again, so a quick sell off could ensue soon. It would seem logical in my mind for the market to hold its course for another week or so that the dumb money can feel more optimistic and would join this rally. I read an article recently that talked about how the .78% fibbonaci retracement level for the S&P is around 1384 which would put the dow around 12100 to 12300. So we could see a move up to that area before a selloff happends. I am liking that scenario more and more especially with the dow closing above 12K.

No comments:

Post a Comment